Table of Content

They still ignored me and charged me a year of escrow on estimated taxes plus about $479 a month extra for taxes. I could us that money in savings and draw interest on it. But no they want to put it in escrow till I get a new tax statement on the house I just purchased. By the time Smith County gets it recorded and on the tax rolls will be in march of next year.

You can also call, text, or email your loan consultant directly from the app. After that, you can enjoy their comprehensive online and mobile app experience. And best of all, over 75% of Movement’s borrowers see their loans processed and closed within a week. Interested borrowers can begin the mortgage application process online by creating an account and filling out a form. USDA home loans are 0% down payment loan options for borrowers in eligible areas, usually rural.

How are Caliber's rates compared to the national average?

Household income cannot exceed current limits, set county by county. Customers tend to be satisfied more often than not with Caliber’s service. Reviews on its page and the Better Business Bureau show mainly positive remarks about the company’s products and services.

Because it is a very large national lender, Caliber's rates will usually be competitive. For borrowers who meet underwriting guidelines and can digitally deliver all required documentation, Caliber Home Loans says it can close a purchase loan in as few as 10 days. Jumbo loans are any mortgages in an amount that exceeds federal loan limits and may have different qualification requirements. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. 42% of Caliber Home Loans employees would recommend working there to a friend based on Glassdoor reviews.

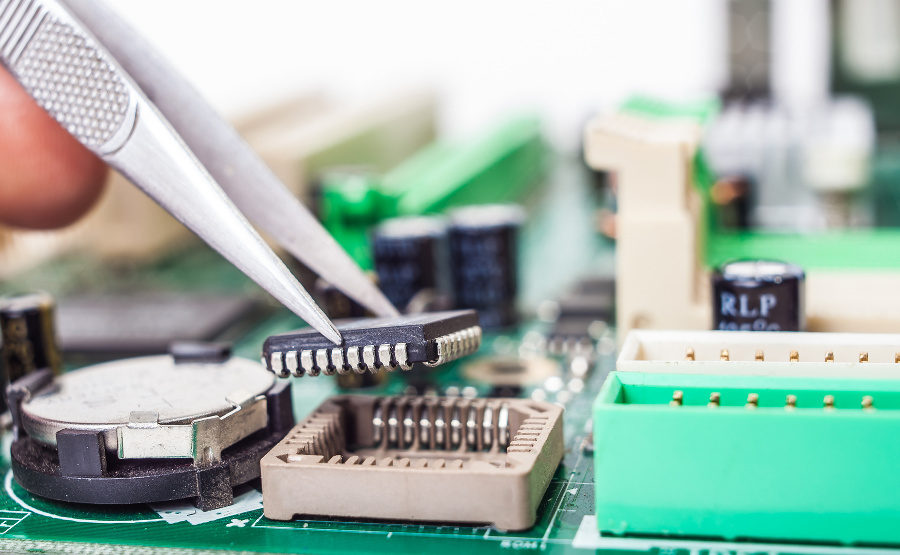

Caliber Home Loans Photos

Customers can manage their applications and accounts through Caliber's online portal or mobile app . During the application process, the mobile app allows you to find a local loan consultant, view the status of your application, and upload loan documents. First-timers and those looking for a low down payment mortgage will find several down payment assistance options. Caliber Home Loans offers to help borrowers experiencing financial hardship caused by COVID-19, a natural disaster, or another significant event. Options can include a monthly payment mortgage forbearance plan, repayment deferral, or even loan modification. I will never want to use Caliber Home Loans again after the way I was treated by 2 ladies in the Irving area.

I wound up shouting at him and hanging up on him during the past two months. As a servicer certain data points still require that I call them directly when I need information to provide for taxes or to other lenders. Their support and their website used to REALLY stink, but both have gotten slightly better in the past 18 months or so. Caliber offers a series of "smart" loans with non-traditional features and flexible guidelines. These are ideal for borrowers who are unable to get approved for traditional mortgage products.

Work at Caliber Home Loans? Share Your Experiences

They also offer reverse and construction loans plus rate-and-term refinancing. Borrowers will need a credit score of at least 580 to qualify for a loan FHA or VA mortgage with Caliber. This is the lowest credit score possible across all the loan programs offered. USDA and conventional loans require a score of at least 620, although you'll need a score of 675 or higher for the most competitive interest rates with the latter. Caliber’s application process can be done from start to finish online through its web platform. The company will ask you to answer a few questions about yourself, your finances and your budget.

Most times when I tried to pay my monthly payment through app I have bad, stressful times. When I tried to do sign in always I see session expired. Very difficult to pay my mortgage payment through this stupid app.

Is Caliber Home Loans a Direct Lender?

So be ready to make a down payment or cover some closing costs. If you don't qualify for a VA loan or a USDA loan, you'll need at least 3% down. If you qualify for a USDA loan, you may be able to roll your closing costs into the loan. Debt-to-income requirements with Caliber Home Loans vary by loan type. For most borrowers, total monthly debt obligations should stay under 43% of total income. You might still qualify for a mortgage with a 50% DTI if the other parts of your application are strong.

VA home loans are 0% down payment loan programs for active duty and former military as well as some spouses. Caliber is a great home loan option that offers more variety than some other lenders, which might make it easier to find what works best for you. It also offers fast closings and some assistance programs for certain borrowers. Many or all of the products here are from our partners that pay us a commission. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. We have not reviewed all available products or offers.

Caliber also performed relatively well in Investopedia’s own survey of 45 mortgage lenders, coming in 14th place with a score of 5.95 out of 10. Most of the recent customer comments mention how reliable and fast the loan officers are, and how their loans closed on time. Caliber Home Loans is a full-service national mortgage origination company that was founded in 2008. The lender originates loans through its network of retail branches, wholesale lending, and correspondent lending platforms. Its headquarters are in Coppell, Texas, which is a suburb of Dallas. Borrowers in search of a jumbo loan will need a credit score of at least 700.

Before last month we were allowed to make payments via debit card making them instant and having no issues whatsoever. Now anytime we have tried to pay with our bank account since they took debit away we have had issues and no help. The first time was resolved fairly quickly, but this time has been worse. They claimed we had "insufficient funds" even though we had well over the amount needed for two weeks and have the bank statements to prove it. Our bank said they had no issues on their end and have yet to receive a charge from Caliber. Their BBB page is riddled with complaints pertaining to payment issues and they still refuse to fix it.

However, customer satisfaction doesn’t manage to reach the industry average, according to J.D. Caliber also features a mobile app on Android and iOS devices to keep track of your monthly payments and view your loan details. Caliber is a well-known lender that managed to firmly establish itself in the mortgage industry in a short span of time.

No comments:

Post a Comment